Why Disney Is an Attractive Investment

70 views - published on June 14th, 2013 in Disney News tagged Disney, disney vacation, timeshares, vacation By Bryan Wagman –

June 14, 2013

| Tickers:

NWS,

TWX,

DIS

| 0 Comments

Bryan is a member of The Motley Fool Blog Network — entries paint a personal opinion of a blogger and are not rigourously edited.

Its thesis parks have been a customary vacation spots for people from all over a universe for years. The Walt Disney Company (NYSE: DIS) was founded approach behind in 1923, and has turn iconic of a American lifestyle. Attracting many visitors any year, their hotel services are some of a best in a world. Surprisingly, though, a association is even some-more widespread in a media industry. With illusory financials corroborated by interesting gratefulness multiples, Disney creates for a good investment.

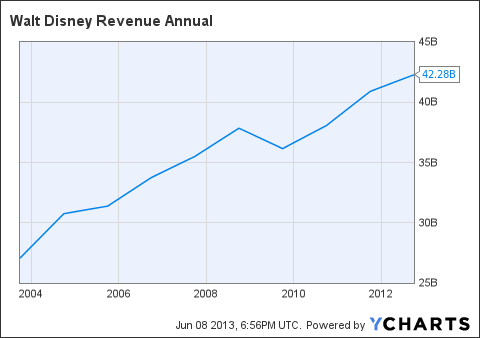

The large association recently reported $42.28 billion in revenue, a towering series to contend a least. In a past 10 years, as Disney grows and improves itself, this series has been augmenting usually during an considerable and unchanging rate, as shown by a draft below.

DIS Revenue Annual information by YCharts

Effectiveness of operations compared to competitors

Disney now has Bob Iger during a helm, and he has finished a smashing pursuit of handling a company. Disney operates in an intensely fit and effective manner, and there are a series of statistics that simulate this. The company’s distinction domain is now during 13.64%. The handling margin? An even some-more considerable 21.19%. The lapse on resources has been 7.40% while lapse on equity has been 15.43%. Undeniably, this statistics uncover a considerable formula that Disney has perceived by handling regulating a strategies that they do.

Now let’s take a demeanour during dual of Disney’s categorical competitors, News Corp. (NASDAQ: NWS) and Time Warner (NYSE: TWX). Although any of these dual companies demeanour considerable in some of these statistical measures, Disney is many some-more unchanging opposite a board. For example, News Corp. has an ROA of usually 5.56%. Time Warner is partially diseased in a distinction domain of 11%.

One of a probable reasons since Disney operates some-more effectively could be since of a fact that it is a many some-more diversified association than a dual competitors. News Corp. and Time Warner don’t have Walt Disney World Resort and Disneyland to tumble behind on if a media attention is strike with a tough quarter. This diversification can assistance Disney keep a margins some-more unchanging and impressive. Just like investors wish a diversified portfolio, a association should wish diversified handling segments.

Narrowing a scope: Disney’s financials and multiples

In early May of 2013, Disney reported results for a quarterly duration finished Mar 30. There were a series of statistics that were utterly enlivening for a company. For example, revenues jumped from $9.629 billion to $10.554 billion. Net income increasing a poignant volume as well, going from $1.226 billion to $1.621 billion. Diluted EPS went from $0.63 to $0.83, an considerable burst to contend a least. The media networks shred (which, discordant to renouned belief, creates adult a incomparable cube of income than parks and resorts) gifted an boost in income from $4.692 billion to $4.957 billion. The 4 other segments that Disney operates were means to boost quarterly revenues as well. These income increases were as follows:

- Media networks: 6%

- Parks and resorts: 11%

- Studio entertainment: 3%

- Consumer products: 9%

- Interactive: 6%

This consistent, all around expansion was accompanied by a few pivotal vital moves, arguably a many critical of that was Disney’s merger of Lucasfilm on Dec 21, 2012.

In a customary contention of formula that comes with any quarterly report, government forked out a few pivotal points. The association attributed a 32% boost in EPS to “improved opening during all of a handling segments led by Studio Entertainment, Parks and Resorts and Media Networks, and a reduce effective income taxation rate driven by auspicious taxation adjustments associated to pre-tax gain in before years.” One motorist of income increases in a media networks shred was an boost of 13% in associate cost revenue. This was essentially a outcome of “increases of 7% from contractual rate increases during ESPN.”

One of a few signs of trouble, despite a somewhat considerate one, was a 7% dump in money supposing by operations (six months ended). This diminution was a outcome of aloft money payments during corporate, studio entertainment, parks and resorts and media networks. This is not that bad of a sign, though, since a lot of a boost in money payments can be attributed to investments in a opposite handling segments, that totaled $1.119 billion.

Because of these clever fundamentals that a business operates with, success appears to be issuing in utterly simply for Disney. At a stream price, Disney’s batch looks really attractive. It is trade during 19.65 times trailing earnings, has a price/book of 2.70, and a price/sales of 2.60. Surprisingly, this is an aspect in that Disney’s competitors seem to have an edge. News Corp. has a 12.60 cost to gain ratio and Time Warner’s is 17.63. we suppose, though, that with a kind of celebrity and confidence that has surrounded Disney for decades on decades, it is not startling to see that a batch has built adult a somewhat aloft reward than that of a competitors. Regardless, a multiples of Disney are still utterly attractive. On tip of all this, Disney offers a $0.75 per share dividend.

The bottom line

Overall, Disney is driven by clever expansion that is occurring during an fit and protected turn and corroborated by countless statistics. If Disney continues to grow and pullulate during a rate it historically has, a batch cost is expected to continue to arise for years to come, as Disney grabs an even incomparable share of both a media and hotel markets.