The Disney Recipe

3 views - published on May 29th, 2013 in Disney News tagged Disney, disney news, disneyland, walt disney, walt disney worldIn a new interview, Jeffrey Katzenberg described his initial day during Disney as a newly allocated conduct of The Walt Disney Studios. The equally new Disney CEO, Michael Eisner, gave him a simple, evident mandate: repair animation during Disney.

Although a maestro in a film business, Katzenberg had no knowledge with animation and small ardour for it. Disney long-timers, however, sensitive him that Walt Disney had left endless annals and audio recordings concerning his practice creation animation, that were stored in a Disney archives.

Looking by these records, he detected that Walt had effectively “left a recipe for creation a Disney charcterised movie.” Katzenberg proceeded to request this recipe with conspicuous success, adding on a approach some additional mixture of his own.

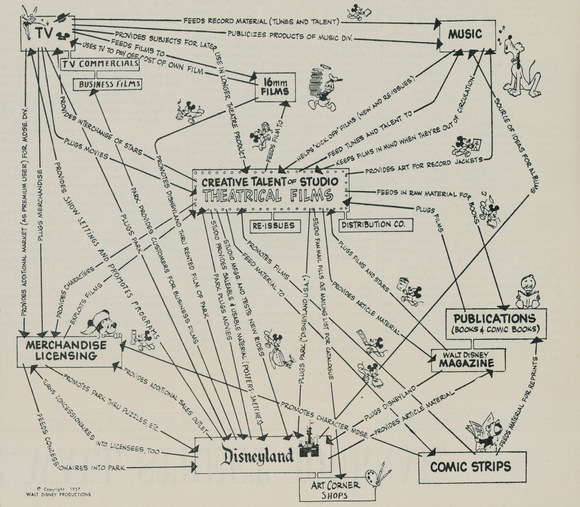

Walt Disney, however, left another, arguably even some-more valuable, recipe for his company. This was a vital recipe or what we call a corporate speculation of postulated growth. This corporate speculation is mostly prisoner in a adjacent sketch also from a Disney archives, published in 1957. It depicts a executive film item that in really accurate ways infuses value into and is in spin upheld by an array of associated party assets.

The map has, of course, developed over a indirect years as additional resources have amassed (in fact, there are elaborating depictions of this Disney synergy map in a archives). While sketch such a map now would need some-more boxes and some-more arrows, (and maybe an eccentric web of companion resources surrounding a ESPN franchise), a elemental patterns and a underlying discernment and premonition would sojourn utterly consistent. The vital prophesy that Walt prolonged ago stoical has suggested a duration of vital possibilities that have fueled a conspicuous record of value formulating growth.

Effective corporate theories like this yield managers with prophesy to navigate a surrounding vital turf over an extended duration of time. They yield a unpractical apparatus and filter — one that can be regularly used to select, acquire, and arrange interrelated bundles of assets, activities, and resources from a contentment available.

As we explain in my HBR article, What Is a Theory of Your Firm, a prophesy supposing by a good speculation has 3 graphic components. First, there is foreknowledge about an industry’s evolution, including applicable technological change or elaborating consumer preferences. Second, there is discernment about a particular and profitable resources and resources of a firm. Finally, there is cross-sight — a ability to brand adjacent resources singly profitable to your organisation or resources with value that others are simply incompetent to perceive.

Such prophesy is vicious as a organisation seeks to acquire resources in rarely rival markets, where a pivotal is not merely noticing synergy with accessible assets. Many firms might also possess synergy with a resources we target. Instead, a pivotal is possibly noticing synergy singular to your organisation — synergy taken to others — or noticing value that while accessible to others, they simply can't see. Only firms that possess such prophesy can attend in markets for resources and predictably beget value post acquisition.

Vision-providing corporate theories need not be as visually constrained as Disney’s synergy map. Many corporate theories are maybe improved prisoner in words. In a educational world, a many absolute theories are during once superb and parsimonious. They explain immeasurable turf regulating though a few brief black or difference — charity constrained predictions about how a universe operates. The hallmark of an effective corporate speculation is one that simply and succinctly captures how a applicable vital turf will conflict and respond as a organisation takes vital actions. It contingency indicate to a duration of vital actions that are value formulating for a firm.

Does your organisation now possess a corporate speculation that reveals foresight, discernment and cross-sight to beam your growth? Does it yield we with transparent predictions about a applicable destiny of your attention (or associated industries)? Does it yield we with a transparent bargain of what is truly particular and singular about your organization? Does it exhibit singly profitable resources and opportunities? If not, it might be time to set about component your possess corporate speculation of value formulating growth.