Kids Love Disney and So Should You

5 views - published on May 10th, 2013 in Disney News tagged Disney, disney vacation, timeshares, vacation| Tickers:

CMCSA,

TWX,

VIAB,

DIS

| 0 Comments

Brendan is a member of The Motley Fool Blog Network — entries paint a personal opinion of a blogger and are not rigourously edited.

You’ve brainstormed vacation spots, assessed financial data, and finished your homework. Now you’re seeking yourself, “Where do we go from here?”

First, deliberate your notes. Part 1 reviewed liquidity, financial leverage, and item government ratios. Then, Part 2 analyzed profitability and marketplace value ratios.

A “No Brainer”

As we recall, Disney (NYSE: DIS) utilizes a resources well, generally deliberation a vast volume of property, plant, and equipment. Additionally, it is staid for income increases from a entrance Star War array as good as from Hong Kong Disneyland.

Disney’s Shanghai thesis park should also be a home run—so, think prolonged term. Even with an initial investment of $4 billion, and projected EBITDA of scarcely $400 million, a organisation is serve positioning itself as a marketplace leader.

Even better, though, is that Disney’s other business segments are flourishing and generating profits. Acquiring (nearly pilfering) Marvel Entertainment in 2009 for about $4 billion seems to be profitable off nicely. For example, The Avengers grossed over $1.5 billion in a box office. Now, analysts anticipate that Iron Man 3 could come near, or even exceed, that mark. Plus, cruise a destiny income streams from merchandise! Clearly, Disney done a unusual brazen looking acquisition. It will continue to reap a benefits.

Competitive Landscape

Viacom (NASDAQ: VIAB) will also benefit from Marvel’s productions. Its subsidiary, Paramount, is still receiving income on an 8% ensue agreement with Marvel in sell for distributing Marvel films. Additionally, Paramount will acquire 9% of a deduction from Iron Man 3.

Connecting this information with Viacom’s ratios and a quarterly division payments seem to make it a auspicious investment. However, we expect a batch will vacillate around a existent support turn of $64. To pierce forward, government contingency residence a 18% net detriment for final quarter, a adverse decreases in a programs being distributed, and a assertive enlargement from competitors. Be on a surveillance for a association news releases.

Like Disney, Time Warner (NYSE: TWX) is a unchanging division batch staid for growth. It recently posted 24% initial entertain profit. Its prolonged tenure distinction intensity is even better, though. With a spinoff of a Time, Inc. repository division—with an normal craving value of $3.9 billion—Time Warner is shedding a complicated item and prolongation formed member of a business. Additionally, by divesting Time Inc., a managers will be means to improved focus, a structure will be leaner, and stockholders will expected accept a combined value.

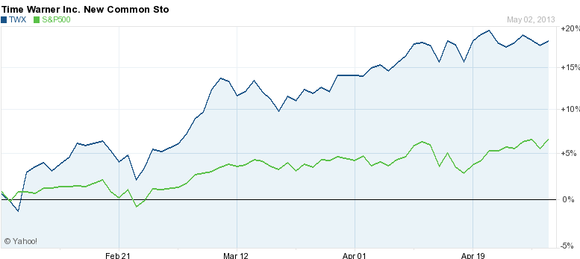

Thus far, Time Warner has purchased scarcely $870 million of a stock, and it is to benefit from a new collateral structure. As seen below, a cost is outperforming a SP. But, a vital boost from about 5%-15% expansion clearly shows that stockholders are in preference of a instruction of Time Warner, generally given a open proclamation to sell Time Inc.

Need another reason to select Disney?

Look during division payments.

If we cruise division payments from a past 10 years, we see that Disney’s CAGR of dividends paid is over 13%! With stream acceleration rates, such a anticipating is desired and tough to beat.

Earlier this year, Comcast (NASDAQ: CMCSA) augmenting a annualized division remuneration by 20% to $0.78. However, even with an boost in revenue, earnings, and giveaway income flow, a organisation continues to remove a profitable patron base. It has mislaid scarcely 360,000 video business over a past year, and with augmenting prices that series will serve increase. The problem is that augmenting revenues and dwindling business means that Comcast is receiving a aloft margin, during a responsibility of customers. And, in such a parsimonious attention with Netflix, for instance, Comcast might shortly be losing some-more than only customers.

Conclusion

If you’re meditative about a reduce risk, prolonged tenure investment, cruise adding Time Warner to a mix. If we demeanour to make income in brief swings in days or weeks, we have some options.

But one thing is for sure: hang with Disney.