Think "Star Wars" Is Fiction? Here’s Proof a Force Is Real

4 views - published on May 5th, 2013 in Disney News tagged Disney, disney star wars, movies, star wars“May a 4th be with you!” So goes a nod for Star Wars Day, a play on a oft-repeated word “May a Force be with you” from a several Star Wars films.

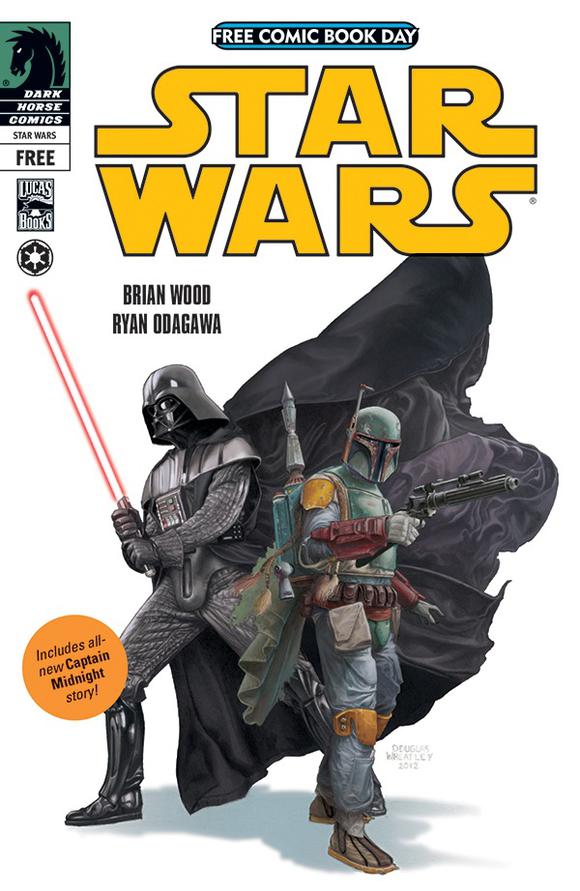

This year a “holiday” fell on Saturday, that also happened to be Free Comic Book Day. (Publishers group with retailers to give divided comics in an bid to captivate kids into a hobby.)

Sources: Dark Horse Comics, Photobucket.

Why should we care? Because Walt Disney (NYSE: DIS ) does. The media firm that also plays home to ABC, ESPN, and a world’s best-known princesses has paid more than $8 billion to get into a sci-fi and comic book business.

The bid is profitable off. Iron Man 3 has amassed scarcely $700 million in sheet sales in a initial dual weeks in tellurian theaters, including $175.3 million in a U.S. debut. Disney’s Lucasfilm group skeleton to have another Star Wars film prepared in 2015.

J.J. Abrams, a male behind a soon-to-be expelled Star Trek Into Darkness for Viacom‘s (NASDAQ: VIA ) Paramount Pictures, will approach a subsequent Star Wars. An act of treachery? we know a few fans who consider so, though that doesn’t lessen Disney’s luminosity in signing him.

The House of Mouse isn’t your usually hope, investors

Bob Iger wants to cultivate a Star Wars universe each bit as most as a Marvel universe, and for good reason: Before it became a partial of Disney, Lucasfilm operated a $3 billion chartering empire.

Expect that sum to grow as a years go on interjection to Disney’s shuttling of a LucasArts gaming division. Any one of a large publishers could land a plum assignment of building a diversion tied to a subsequent underline film in a series.

In a meantime, clothiers, toymakers, diversion publishers and some-more will continue to compensate to use Star Wars characters and imprints in artistic and infrequently ridiculous ways:

Sources: Rovio, YouTube.

And that’s important. Investing in a Star Wars star doesn’t have to meant investing in Disney. Here are 3 other bonds with Jedi credentials:

-

Amazon.com (NASDAQ: AMZN ) . A hunt for “Star Wars” among a e-tailer’s register brings adult some-more than 114,000 opposite products for sale. To be fair, we could contend something identical about Target and Wal-Mart, though shopping Amazon also gets we entrance to a fast-growing Web Services and Instant Video businesses.

-

Like Amazon, Apple (NASDAQ: AAPL ) sells a far-reaching accumulation of Star Wars products, though in digital form. For example, some-more than 2,100 have rated deteriorate 1 of Star Wars: The Clone Wars radio show, that costs $39.99 in HD during a iTunes Store.

-

Finally, there’s Hasbro (NASDAQ: HAS ) , that sells a full line of Star Wars toys by a permit hereditary with a 1991 merger of Tonka and auxiliary Kenner, that done a strange Star Wars movement total we can still find on eBay.

Did we applaud Star Wars Day? What about Free Comic Book Day? Please leave a criticism to let us know what we consider about investing in Disney or any of a other bonds occupying apart tools of a Star Wars universe.

It’s easy to forget that Walt Disney is some-more than only a House of Mouse. True, Disney entertainment parks around a universe hosted some-more than 121 million guest in 2011. But from a immeasurable catalog of characters to a beast collection of media networks, most of Disney’s allure for investors lies in a diversity, and The Motley Fool’s reward investigate news lays out the box for investing in Disney today. This news includes a pivotal equipment investors contingency watch as good as a opportunities and threats a association faces going forward. So don’t skip out — simply click here now to explain your duplicate today.