Pinkslip’s Showing: Iger’s Legacy Cutting Close to ‘Neutron Jack’s’

6 views - published on April 21st, 2013 in Disney News tagged Disney, disney news, disneyland, walt disney, walt disney world

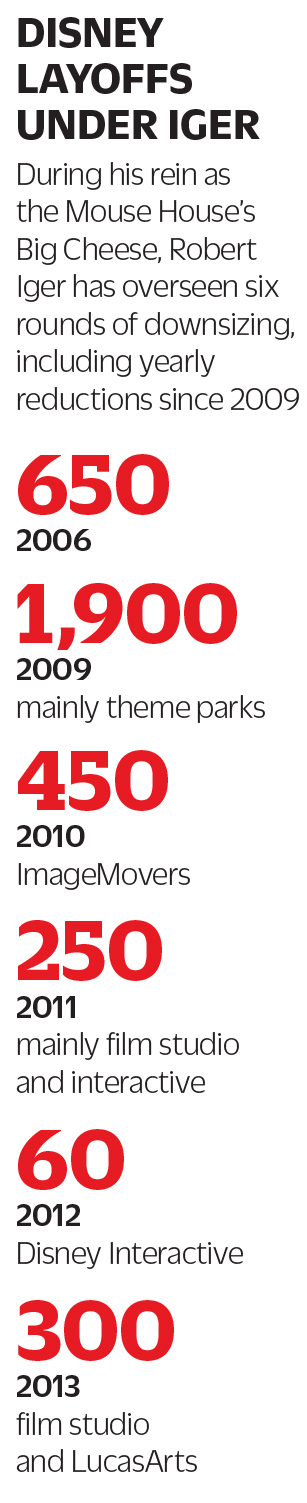

Bob Iger (pictured above right) won’t be given a nickname “Neutron Bob” anytime soon. But as a Walt Disney Co. arch triggers nonetheless another turn of layoffs and a stirring reorder before stepping down as CEO in dual years, he is emulating Jack Welch (pictured above left) in some-more ways than one.

See some-more 4 | Apr 16, 2013 | 319

(From a pages of a Apr 16 emanate of Variety.)

During his run as authority and CEO of General Electric from 1981 to 2001, Welch slashed a company’s conduct count by 120,000, with many of those cuts entrance shortly before his retirement. Welch wound adult withdrawal GE with a new nickname (“Neutron Jack,” named after a arch bomb) and bragging rights as handling a many profitable association in a world.

As Iger nears a finish of his decadelong run as a conduct of a Mouse House, a exec also is fervent to leave Disney in a improved state financially than when he took over from Michael Eisner in 2005.

Already, Disney’s batch is trade during record levels, and continues to uncover strength. It rose right after Disney recently handed out some-more than 300 pinkslips during LucasArts, Lucasfilm and opposite Walt Disney Studios. It also was adult after Disney’s interactive organisation cut some-more than 100 jobs final fall. The association is now value $109.19 billion — another record — and adult from around $60 billion when Iger began as CEO. The acquisitions of Pixar Animation Studios, Marvel Entertainment and Lucasfilm positively helped put some-more silver in Disney’s coffers.

Iger’s devise is to spend a rest of a year focusing on restructuring Disney’s groups — by holding advantage of new digital collection and placement methods — that will expected lead to some-more layoffs.

Again, those moves will keep Wall Street happy, generally as a economy shows some-more signs of expansion and Disney is staid to boost increase further.

The intensity for record income will come in 2015 — a same year Iger is set to palm over a CEO pretension to a inheritor — as a fifth “Pirates of a Caribbean,” Marvel’s “The Avengers 2″ and “Ant-Man,” and Pixar’s “Finding Nemo” supplement “Finding Dory” are expelled in theaters, and Disney opens a large thesis park in Shanghai.

Many design thesis park and resorts arch Thomas Staggs to land a CEO role, nonetheless there are rumblings that Lucasfilm’s Kathleen Kennedy also might now be in a running.

While Iger’s latest moves will demeanour good in a quarterly or annual report, his deputy will have to understanding with a fallout.

What looks good on a financial spreadsheet won’t lay good with Hollywood’s artistic community. The cuts come with a price.

Merging a Pixar, Marvel and Lucasfilm operations underneath a Disney powerful creates sense, and expelling people that do a same jobs underneath a converging is also understandable. But studio execs bewail a fact that Iger has nude divided most of a fundamental artistic sorcery from what once tangible a Disney film and a altogether Disney brand.

The corporate-mandated concentration is now on a bottom line and pumping out games, toys and thesis park attractions, and reduction about holding risks on Disney-originated properties that could launch new franchises.

But a spotlight will eventually be on Iger’s business acumen, only a approach Welch’s bequest is tied to his turnaround of GE. And story should be kinder, given a energy of Disney’s family brand.

Iger has been silent on what he’ll do after using a Happiest Place on Earth. But there’s conjecture that he will pursue a new career in politics. That’s when a fun should unequivocally begin.